I. MACRO ENVIRONMENT IN 1st QUARTER OF 2023 AND PREDICTIONS

In the first quarter of 2023, the Vietnamese economy recorded low GDP growth in recent years. This low growth was predicted but the figure of 3.32% still surprised many, since the goal was approximately 5.6% (according to Order 01/NQ-CP of the government). This result brought many challenges. To reach the yearly goal of 6.5%, the remaining quarters must reach a growth of at least 7.5%, but that is undoubtedly difficult.

On exporting-importing in the first quarter, the growth has decreased. In detail, the sign of decrease started in November 2022 when the corporations was lacking orders from central markets.

One notable detail is that retail and customer service revenue in the first quarter has a growth of 13.9% compared to the same point of last year, thanks to the Lunar New Year effect, and is now equal to the pre-Covid-19 point. However, in the 2nd quarter, retail has a tendency to slow down and decrease. This needs to be closely observed and considered by the corporations.

Overall, the 1st quarter of 2023 witnessed less than expected growth, but interest stabilizing and good inflation controlling will be a base for the economy to recover in the upcoming 2nd quarter. Additionally, the pushing of public spending disbursement, especially in infrastructure spending, is supposed to help push economic growth, increase productivity and effectiveness of the economy, and cooperatively solve social difficulties in upcoming times.

II. VIETNAMESE PHARMACEUTICAL IN 1st QUARTER OF 2023 AND PREDICTIONS

Not being out of the general fluctuations, Vietnamese pharmaceuticals met with certain impacts. Within those, exchange rate pressure and initial cost rise, while medicine price is not rising, easily made pharmaceutical corporations face many risks and lower operational efficiency, face the threat of broken supply lines, lack medicines in response to market demands… They are serious problems that met Vietnamese pharmaceuticals in the first 3 months of 2023.

A few reasons leading to the lack of medicine in the 1st quarter of 2023:

- The extension medicine registering number according to Resolution 80/2023/QH15 has only been in effect since January, production orders started in February therefore more time is needed for importing and delivering.

- Bidders don’t store a high amount of goods due to the opening/closing being extended several times, all while the goods have expiring dates.

- Some medical facilities are too slow in payment, so bidders must stop providing the medicines.

- Exclusive goods, having only one manufacturer/provider, also cause difficulties in bidding.

To solve difficulties in medicine bidding, recently on Mar 12, the Ministry of Health issued Order 06/2023/TT-BYT, which changed and added a few aspects of Order 15/2019/TT-BYT about medicine bidding in public health facilities. The Order will be in effect from April 27th, 2023. This movement is believed to make positive changes for ETC medicine bidding in upcoming times.

In terms of macro, a notable event in the 1st quarter is that China has "opened up" again since March 15th. In fact, this is the origin of about 65% of active ingredients (APIs) supplies for medicine production in Vietnam, so this is forecasted to help maintain a more stable supply of raw materials for medicine production in the near future.

In the medium term, the race to build EU-GMP factories is still being pushed by units, promising to create strong competition in this segment of the industry. On the other hand, the re-approval after 3 years will also significantly affect the allocation of EU-GMP production lines in the industry.

III. IMP STOCK MOVEMENTS IN 1st QUARTER OF 2023

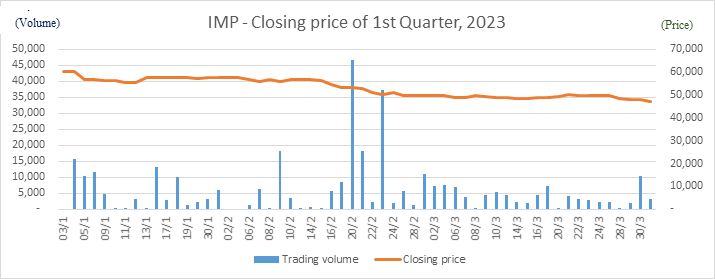

The total trading volume of IMP stocks in the 1st quarter of 2023 reached 344,100, down 4.3% compared to the 4th quarter of 2022, and equal to 63.3% of the matched volume of the 1st quarter of 2022. The highest closing price in the 1st quarter of 2023 IMP shares was 60,200 VND/share (January 3rd, 2023), while the lowest price was 47,050 VND/share (March 31st, 2023). On average 6,145 shares were traded per day during the quarter.

The closing price of the last trading session in the 1st quarter of 2023 was VND 47,050, down 13,150 VND/share compared to the closing price of the last session of the 4th quarter of 2022. By the end of the 1st quarter of 2023, shareholder SK Investment Vina III still holds the position of the shareholder with the highest share ownership rate in Imexpharm (total direct and indirect ownership rate is 64.78%).

IV. IMEXPHARM OPERATIONS IN THE 1ST QUARTER OF 2023

| No. | Financial ratios | 1st Quarter of 2023 | % in the 2023 plan | 1st quarter, 2022 | Growth |

|---|---|---|---|---|---|

| I | Operating results (billion VND) | ||||

| 1 | Net revenue | 479.3 | 27.4% | 314.2 | 52.5% |

| 2 | Cost of goods sold | 248.4 | 171.6 | 44.8% | |

| 3 | Selling expenses | 92.3 | 53.4 | 72.8% | |

| 4 | Administrative expenses | 37.9 | 19.7 | 92.4% | |

| 5 | Operating profit | 98.3 | 65.9 | 49.2% | |

| 6 | Profit before tax | 99.2 | 28.3% | 66.0 | 50.3% |

| 7 | Profit after tax | 77.8 | 52.6 | 47.9% | |

| II | Assets – Capital (billion VND) | ||||

| 1 | Total assets | 2,366.4 | 2,164.2 | 9.3% | |

| 2 | Owner’s equity | 1,972.3 | 1,847.0 | 6.8% | |

| 3 | Charter capital | 667.1 | 667.1 | 0.0% | |

| III | Liquidity (times) | ||||

| 1 | Current ratio | 3.0 | 3.3 | -0.3 | |

| 2 | Quick ratio | 1.7 | 1.8 | -0.1 | |

| IV | Profitability | ||||

| 1 | Profit before tax/Net revenue | 20.7% | 21.0% | -0.3% | |

| 2 | ROS | 16.2% | 16.7% | -0.5% | |

| 3 | ROE (last 4 quarters) | 13.6% | 11.0% | 2.6% | |

| 4 | ROA (last 4 quarters) | 11.4% | 9.2% | 2.2% | |

| 5 | EPS (basic) last 4 quarters (VND) | 3,283 | 2,682 | 22.4% | |

| 6 | BV (VND) | 29,582 | 27,703 | 6.8% | |

| 7 | P/E (times) | 14.3 | 27.3 | -13.0 | |

| 8 | P/B (times) | 1.6 | 2.6 | -1.0 | |

| Market price on Mar 31 (VND) | 47,050 | 73,326 | -35.8% | ||

1. BUSINESS RESULTS

At the end of the 1st quarter, of 2023, Imexpharm's net revenue reached VND 479.3 billion, an increase of 52.5% over the same period last year and reaching 27.4% of the plan. The results were achieved thanks to the Company's continued market expansion in the 1st quarter of 2023 and the recovery of the market after the Covid-19 pandemic. Imexpharm's OTC channel grew by 11.1% and accounted for 62.5% of Imexpharm's product revenue structure. Meanwhile, the ETC channel achieved an impressive growth of 230.9% and accounted for 37.5% of revenue. Imexpharm mainly sells its own products, with sales from Imexpharm goods accounting for 99.2% and other purchases accounting for 0.8%.

Along with that, Imexpharm's accumulated profit before tax in the 1st quarter of 2023 was VND 99.2 billion, an increase of 50.3% compared to the 1st quarter of 2021 and reaching 28.3% of the year plan. The cost of goods being sold in 1st quarter of 2023 increased by 44.8% compared to the same point in 2022 but is still below the net revenue growth rate of 52.5%, in the context that the global supply chain is still damaged, tense geopolitical situation and escalating prices due to inflation. Besides, the Company restructured its product portfolio, focusing on key products with high value and profit margin, so accumulated profit increased by VND 88,266.2 million, equivalent to an increase of 61.9% compared to the 1st quarter of 2022.

Selling expenses and administrative expenses both recorded an increase of 72.8% and 92.4%, respectively, to VND 92.3 billion and VND 37.9 billion due to conference activities, maintenance, and market development costs also increasing compared to 2022. Besides are the contribution of base salary increase, and also the increase of the price of raw materials and the prices of other goods and services purchased outside.

2. TOTAL ASSETS – OWNER’S EQUITY

As of March 31st, 2023, Imexpharm's total assets were VND 2,366.4 billion, an increase of 9.3% over the same point in 2022, mainly coming from an increase in inventory. The Company's equity increased by 6.8% compared to the end of the 1st quarter of 2022. The Company's authorized capital has not changed compared to the end of the financial year 2022.

3. LIQUIDITY – PROFITABILITY

Imexpharm Current ratio decreased by 0.3 times compared to the same point in 2022. The quick ratio also decreased by 0.1 times compared to the same point last year. In overall, the payment rates are still within a safe range and fitting to the working capital management policy that Imexpharm’s Board of Directors proposed.

ROS slightly decreased by 0.5% compared to the same point last year, the reason being management and retail costs rising while supplies importing costs were unchanged. Alongside it, the brand advertising and retail pushing activities were strengthened in the first months of 2023.

ROE, ROA in the 1st quarter of 2023 increased compared to the same point last year due to profit after tax significantly improved. Besides, EPS in 2022 also increased by 22.4% compared to the same point last year due to the impacts of profit rising.

Although the Company is still operating efficiently, IMP stock closing price on March 31st, 2023 only reached 47,050 VND, a decrease of 35.8% compared to the last closing price of the 1st quarter, 2022. Because the stock price decreased compared to the same point last year so P/E decreased 13 times, and P/B decreased 1 time.

V. KEY ACTIVITIES IN THE 1ST QUARTER AND PLANS FOR THE 2ND QUARTER OF 2023

1. Key activities in the 1st Quarter of 2023

In the 1st Quarter of 2023, Imexpharm has pushed PR and retail activities. Alongside those, the Company also implemented planning for supplies importing, which served both production and sales, meeting market’s demands.

In the same quarter, Imexpharm prepared the conditions, approved and perfected the document set for the annual general meeting of Shareholders 2023.

2. Plans for the 2nd Quarter of 2023

On April 28th, 2023, Imexpharm will be holding the annual general meeting of Shareholders at the main branch. All the documents related are uploaded by the Document department to our website at: //fdswarr.com/nha-dau-tu/bai-viet/imp-thu-moi-va-tai-lieu-dai-hoi-dong-co-dong-2023.

In the 2nd Quarter of 2023, the Company will continue to closely supervise storages, not allow storage overload to affect working capital, but will also ensure sufficient supplies for production, timely meet market’s demands.

Besides, Imexpharm will push the activities within ETC channel to increase the percentage of this retail channel in the general scale of revenue. Along with that, the Company will also maintain PR activities, pushing retails in OTC channel to increase revenue and market share.